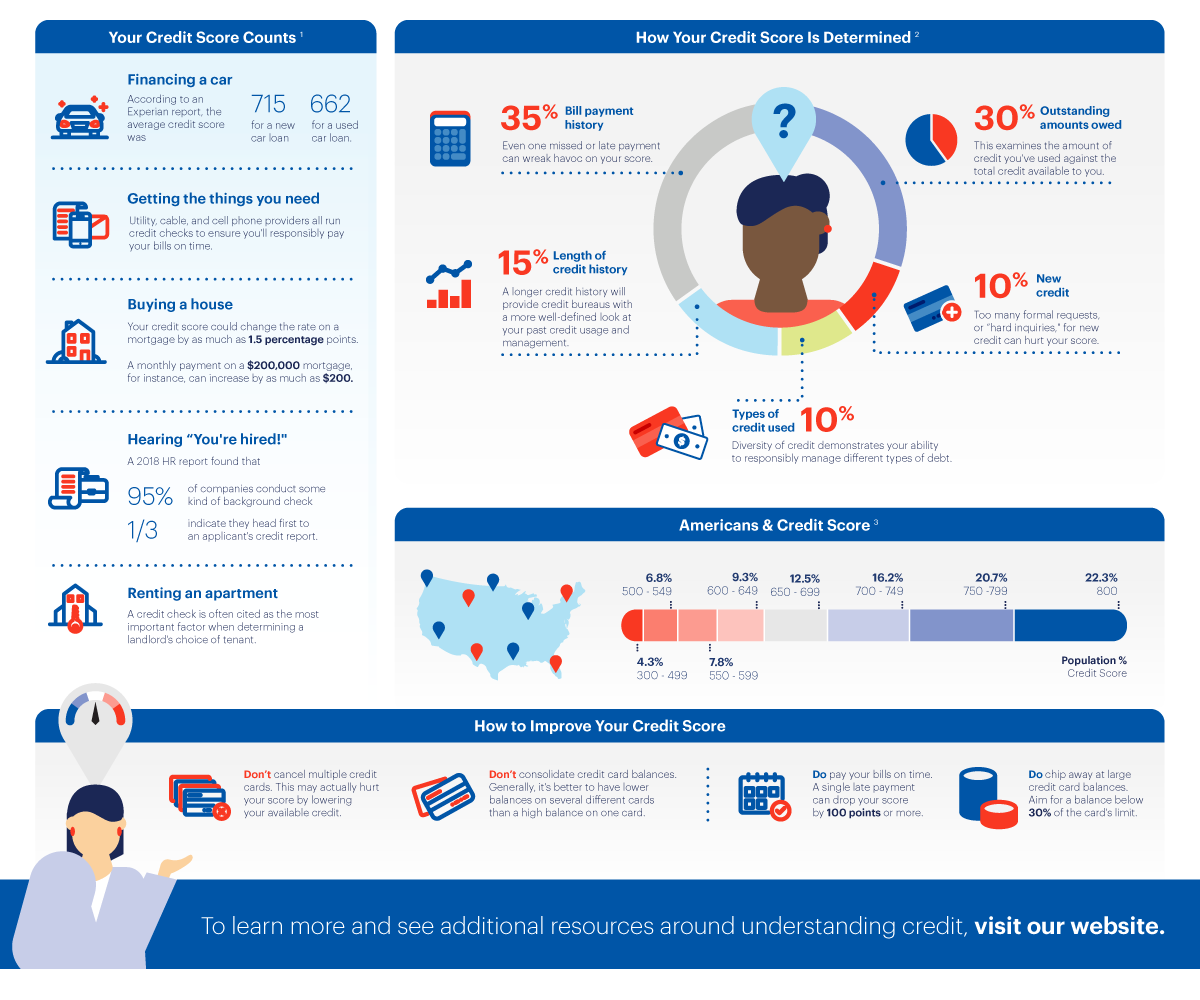

Managing your credit and using it responsibly is about more than just money. It can impact many facets of your life, from buying a home, renting an apartment, financing a car, getting a job, to even buying a cell phone. Understanding exactly what comprises your credit score, why it matters, and how you can boost your credit standing is key to securing a solid financial future.